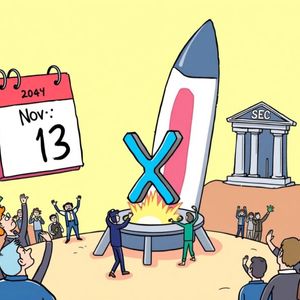

A wave of green has swept across the XRP market, capturing global attention. XRP-linked exchange-traded funds (ETFs) are surging, signaling renewed investor confidence. Traders and institutions are beginning to recognize that XRP’s quiet buildup of fundamentals may finally be converging with price action. Institutional Momentum Builds X Finance Bull, a well-known market analyst, reported that every live XRP ETF recorded double-digit gains in the latest session. This surge is not an isolated event. Data from several market trackers confirm strong inflows into regulated XRP investment products across multiple regions. The pattern suggests institutional players are positioning for long-term exposure rather than short-term speculation. BOOM! All live $XRP ETFs are up! double-digit gains across the board! Who said $XRP had no momentum? Institutions are quietly loading while the crowd still debates. When liquidity meets legitimacy, price follows conviction. This is the start of the next phase! pic.twitter.com/jlcE1Qpgnu — X Finance Bull (@Xfinancebull) October 28, 2025 Why XRP ETFs Matter ETFs offer investors a regulated gateway to digital assets, thereby eliminating concerns related to direct custody. XRP-focused ETFs are now live in Canada , Brazil , and certain European markets, where they’ve already attracted significant capital inflows. These funds allow institutions to gain compliant exposure to XRP, helping transform it from a volatile token into a recognized asset class. This legitimacy often precedes major liquidity expansions and price revaluations. Data Confirms the Trend Market data shows consistent ETF inflows over the past two weeks. Ripple-related products have seen a rise in assets under management, reflecting growing investor conviction. Simultaneously, exchange reserves of XRP continue to fall, indicating that holders are moving assets off trading platforms into longer-term positions. Analysts describe this as “smart money accumulation,” a phase that often precedes larger rallies. We are on X, follow us to connect with us :- @TimesTabloid1 — TimesTabloid (@TimesTabloid1) June 15, 2025 The Role of Liquidity and Legitimacy Liquidity and legitimacy are converging for XRP. The presence of live ETFs ensures institutional-grade liquidity, while regulated frameworks reduce risk perceptions. This dual effect often amplifies price reactions during times of inflow surges. As more jurisdictions approve similar products, the cumulative impact could trigger broader price discovery for XRP. Risks and Caution Ahead Despite the optimism, some analysts advise caution. ETF growth depends on sustained demand, market stability, and clear regulatory guidance. Volatility remains a constant factor, and sudden macro or legal shifts could reverse gains. To confirm sustained institutional participation, investors are advised to monitor fund flows, daily trading volumes, and issuer announcements. In conclusion, the broad rise across all live XRP ETFs marks a pivotal moment for the asset. As X Finance Bull highlighted, institutions are quietly loading up while the public remains cautious. This alignment between regulated products and rising demand could define the next major phase for XRP. If momentum continues, XRP’s transformation from a contested crypto to a recognized global asset may already be underway. Disclaimer : This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses. Follow us on Twitter , Facebook , Telegram , and Google News The post All Live XRP ETFs Are Up! Double-Digit Gains Across the Board appeared first on Times Tabloid .